uber eats tax calculator nz

Rideshare accounting and tax advice and guide to New Zealand rideshare driving for companies like UberZoomyOlaUber Eats etc. However much of this is similar for other gigs like.

Uber Eats Food Delivery Apps On Google Play

The IRD will catch up one day and the small penalties compound and become relatvely huge.

. Learn more on irsgov. For income tax you must. You may also have to pay goods and services tax GST on your ride-sharing income.

I am doing uber eats and need to lodge my tax. Uber pays weekly which is great for you spreadsheet. I put together a calculator that works out what pay rise you actually need so you after-tax income rises to match inflation.

Thats how I did it. Ride-sharing fares paid to you are taxable income. Well send you a 1099-K if.

Uber Eats does not subtract taxes from your earnings so you will need to account for that when you file your tax return. Your total business miles are 10000. This Uber Eats tax calculator focuses on Uber Eats earnings.

Uber NZs tax and costs Uber New Zealand Technologies incurred costs of 976287 resulting in a pre-tax profit of 33561. All you need is the following information. Average income for Uber drivers will vary on the circumstances of each driver but an average income of 25 to 35 per hour after Uber takes its cut is about average.

Uber also issues quarterly statements which dont line up with the above. If your turnover is under 60000 you may register for GST voluntarily. While it paid 9397 in tax based on the company tax rate of 28 percent its total tax bill for 2014 was 33910 due to deferred tax incurred in 2013 its first year of operation in New Zealand.

How is this handled. TurboTax Self-Employed will ask you simple questions about your life and help you fill out all the right forms. Using our Uber driver tax calculator is easy.

There is a lot of confusion around GST registration for Uber drivers. Because I actually only earn 5000. In the US Uber claimed driver partners could make between 70000 and 90000 pa but the average income appears to be closer to 15 to 25 per hour.

Get contactless delivery for restaurant takeaway groceries and more. Your average number of rides per hour. Perfect for independent contractors and small businesses.

Learn more on the Inland Revenue website. The average number of hours you drive per week. This article is not meant to completely explain taxes for Uber Eats drivers.

A passenger uses a third-party digital platform such as a website or an app to request a ride for example Uber Zoomy or Ola. Being a food delivery driver for other gigs like Doordash Grubhub Instacart etc. You use the car to transport the passenger for a fare.

Find the best restaurants that deliver. Fees paid to you when you provide personal services are taxable income. 10000 20000 5 or 50.

Therefore you might receive a 1099-K for amounts that are below 20000. I cant easily calculate my usage as I check my Uber apps daily but only work casually when I feel like it. According to financial accounts filed with the New Zealand Companies office Uber declared gross revenues of 1061018 in New Zealand in 2014 but paid just 9397 in income tax.

You will need to register for a GST number in New Zealand if your earnings exceed 60000 in a 12-month period. Phone is monthly 110 total. Easiest way is to call the Uber Driver Partners Hotline.

I recieved summary from Uber I am still confusing with about fare breakdown 8000 and potential deduction uber service fee 3000 how much should I put on my tax declaration 5000 or 8000 with 3000 deduction. According to the IRD you must register for GST if you carry out a taxable activity and your turnover was 60000 or more in the last 12 months or will be 60000 or more in the next 12 months. Income tax and GST.

Dont have an account. Uber Eats is growing in popularity in New Zealand and Australia. This includes revenue you make on Uber rides Uber Eats and any other sources of business income.

Tax returns for taxi and courier drivers. This is kind of a let-me-google-that-for-you level question. As an independent provider of transportation services you will be responsible for your own taxes when driving for rideshare companies.

Someone on the. She said she also deducts A50 per week so she can pay the money directly to. On average a typical Uber Eats driver can make 15 or more per hour.

Must declare all income you receive in your tax return. Order food online or in the Uber Eats app and support local restaurants. You may also have to pay goods and services tax GST.

Youre being a bit harsh but youre right. Your 1099-K is an official IRS tax document that includes a breakdown of your annual on-trip gross earnings. If you want to get extra fancy you can use advanced filters which will allow you to input.

Average Uber Eats Pay Per Hour. Vincentrideshareconsultantsconz 09 217 3486. This is the first time Im trying to fill an IR3 for uber eats and I couldnt figure out how to do it through myIR.

Can claim certain expenses as income tax. Sign In Email or mobile number. Uber Drivers Lyft drivers and other rideshare drivers.

Remember you will make more money depending on the time and the days you choose to deliver food. Do I just divide by 4 to get weekly. Using Uber as an example your total or gross revenueturnover will be the fares that the customers pay standard fares surge cancellation fees waiting time booking fees airport tolls.

I posted a few days ago about how NZ hasnt increased our tax brackets for inflation. If youre providing your time labour or services through a digital platform for a fee you. The amount of money an Uber Eats driver makes per hour greatly depends on the city theyre serving.

5000 x 5 2500 which is the amount you can claim. Certain states have implemented lower reporting thresholds. Unlike rides with Uber drivers who earn with Uber Eats are only obligated to register collect and remit sales tax from the moment they reach 30000 of revenue over the past 4 quarters.

The city and state where you drive for work.

Doomsday Prep For The Super Rich The New Yorker

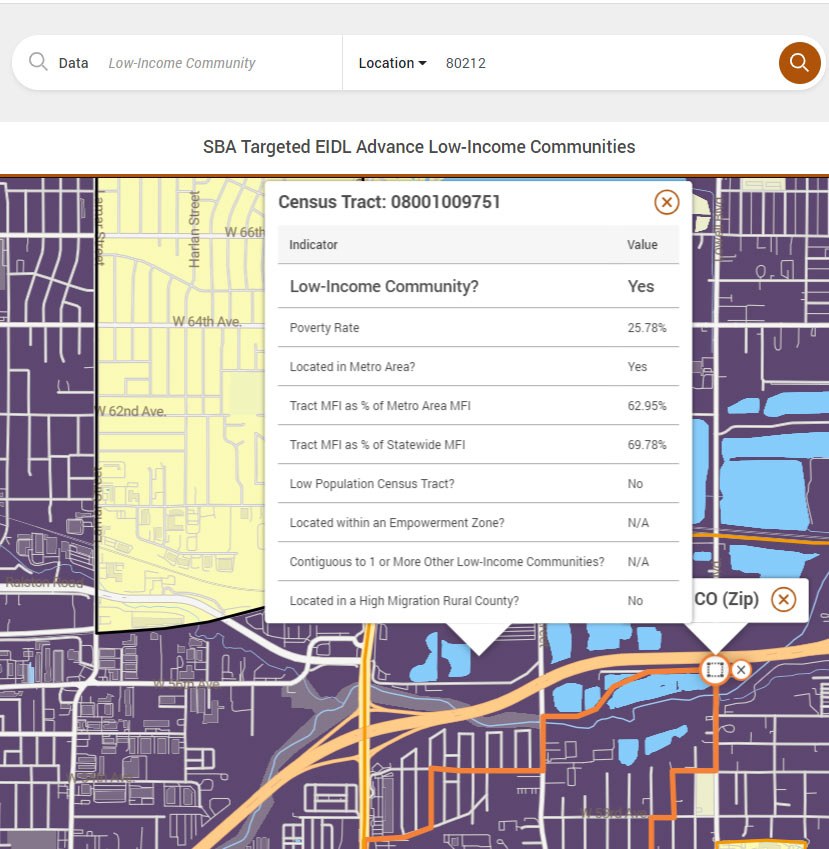

How To Tell If You Re In A Low Income Community Eidl Entrecourier

How To Tell If You Re In A Low Income Community Eidl Entrecourier

14 Best Delivery Jobs With Highest Pay Gigs For Now

Uber Eats Trades Its Flat Delivery Fee For Sliding Scale Payments

14 Best Delivery Jobs With Highest Pay Gigs For Now

The Best Uber Eats Online Coupons Promo Codes Apr 2022 Honey

Doomsday Prep For The Super Rich The New Yorker

The Best Uber Eats Online Coupons Promo Codes Apr 2022 Honey

Coronavirus What Stores And Services Are Still Open During Lockdown Stuff Co Nz

Uber Eats Trades Its Flat Delivery Fee For Sliding Scale Payments

Uber Eats Food Delivery Apps On Google Play

58cm Extra Large Insulated Food Bag Collapsible Transport Tote Perfect As Grocery Shopping Delivery Bags Reinforced Handles Superb Dual Zipper Amazon Com Au

How To Tell If You Re In A Low Income Community Eidl Entrecourier

How To Tell If You Re In A Low Income Community Eidl Entrecourier

Uber Eats Trades Its Flat Delivery Fee For Sliding Scale Payments

14 Best Delivery Jobs With Highest Pay Gigs For Now

How To Tell If You Re In A Low Income Community Eidl Entrecourier